Canadian Securities Course Exam 1 Questions and Answers

What is the difference between sinking funds and purchase funds concerning the redemption of bonds poor to maturity?

What Is the requirementestablished by the Canadian Radio-television and Telecommunications Commission that applies to an advisor who is cold calling potential new clients?

What is the portion of annual profit held by a company after the payment expenses and the distribution of dividends?

What is the mostcost-effectivechannel an investor can use to Invest in derivativeproducts?

What is a Key assumption ofthe expectations theory?

Haw are retail stock and bond transactions settledon a daily basis amongdealers?

What is a company likely trying -c achieve when ituses a stock spit as part of itscorporate strategy?

Keith has a $150,000 term deposit with ABC Trust Company and a $75.000 term depositwithXYZ Trust Company. Both term deposits nave a maturity date of four years and both trust companies are member institutions of the CDIC. How much is Keith cowered for under COIC if both trust companies become insolvent?

Which statutory right allowsa purchaser to caned their order if a prospectus has a misrepresentation?

What will happen ita country's central government is at risk of defaulting on its debt?

Based on market capitalization. which sector of the SSP.'TSX Composite index has one of the highest weightings withinthe index?

Which activity performed bythe Bank of Canada reflects role as the fiscal agent for the federal government?

When acting as a principal, how do investment dealers generate revenue?

An investor has earned additional Income and is looking to invest in a security that guarantees returns over. The next seven years. What is the Best option for purchase?

A politician promises to lower income taxes and increase government spending on social programs. but once selected her government’s high debt level prevents her from doing so. Which challenge has this politician faced?

What is the best way to measure the performance of stock indexes?

What tern describes the requirementof registrants to collectextensive personal and financial Information from individuals before making an investment recommendation?

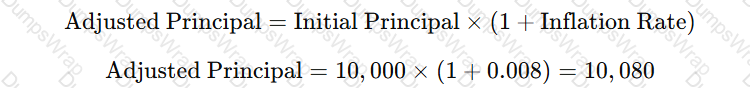

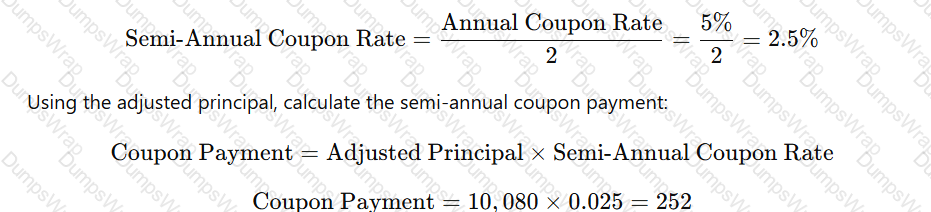

Brice purchased a $10.000 real return bond. The bond has a 10-year term to maturity and an annual coupon of 5% paid semi-annually. If the Consumer Price index increases by 0.8% over the next six months, what is the amount of Brice's first coupon payment?

What is one at the advantages for the company when shares are publicly listed?

Which type of bond offers the investor a choice of interest payments in either of two currencies?

A large corporation has issued the following securities:commercialpaper, first mortgage bonds, and equipment trust certificates Which ranging of the securities is correctly seated from most secure to teas: secure?

Diana was appointed a senior vice president of the ABC inc. She is also a member of the board of XYZ Company where ABC inc, is a % stockholder. What best describes Diana’s insider reporting obligations to the regulator?

Where would the description da company's fixed assets normallybe found?

What is the likely outcome attheend of a five-year term of a rate-reset preferred share if the issuer does not redeem the shares?

The consumerprice index was 125.9 in Decemberoflast year and 123.0 in December ofthe year before What was the inflation rate last year?

A bond with a duration of five is currently priced at $103. If Interestrates rise by 2%. approximately what win be me bond's price?

What is one feature of a generalpartnership?

What is the settlement date for Government of Canada bones?

What is margin in an equity transaction?

Which type of bond allows the issuer to redeem at a specified premium prior to maturity?

A white paper with black text

Description automatically generated

A white paper with black text

Description automatically generated