Advanced CAMS-Financial Crimes Investigations Questions and Answers

A KYC specialist from the first line of defense at a bank initiates an internal escalation based on a letter of credit received by the bank.

MEMO

To: Jane Doe. Compliance Manager, Bank B From: Jack Brown, KYC Specialist, Bank B RE: Concerning letter of credit

A letter of credit (LC) was received from a correspondent bank. Bank A. in Country A. in Asia with strict capital controls, providing guarantee of payment to Bank B's client for the export of 10 luxury cars located in Country B. located in Europe. Bank A's customer is a general in the army where Bank A is headquartered.

The information contained in the LC is as follows:

• Advising amount per unit 30.000.00 EU •10 units of BMW

• Model IX3

• Year of registration: 2020

Upon checks on Bank B's client, the exporter mentioned that the transactions were particularly important, and a fast process would be much appreciated in order to avoid reputational damage to the firm and the banks involved in the trade finance process. The exporter has a longstanding relationship with Bank B and was clearly a good income generator. The exporter indicated that, as a general, the importer was trustworthy.

The relationship manager Feedback from the RM: The RM contacted the exporter for a client courtesy visit, but it was rearranged four times as the exporter kept cancelling the appointments. When the exporter was finally pinned down for an interview, employees were reluctant to provide clear answers about the basis of the transaction. The employees were evasive when asked about the wider business and trade activity in the country. Findings from the investigation from various internal and external sources of information: • There were no negative news or sanctions hits on the exporter company, directors, and shareholders. • The registered address of the exporting business was a residential address. • The price of the cats was checked and confirmed to be significantly below the market price of approximately 70,000 EU, based on manufacturer's new price guide. • The key controllers behind the exporting company, that is the directors and During the investigation, the investigator determines that a nephew of the general.....

Online payments from a customer's account to three foreign entities trigger an investigation. The investigator knows the funds originated from family real estate after an investment company approached the customer online. Funds were remitted for pre-lPO shares. Which should now occur in the investigation?

Which is the first valid step in the Mutual Legal Assistance Treaties international cooperation process?

An AML investigator at a bank identifies an unusually high number of deposits from a few customers resulting from the encashment of multiple gambling tickets from a legitimate gambling company. It is noted that the transactions are inconsistent with the customers' profiles and that reverse (corrective) transactions did not occur. Which suspicious activity is most likely?

How does the Asian/Pacific Financial Action Task Force

A compliance analyst is reviewing the account activity of a customer that they suspect may be indicative of money laundering activity. Which is difficult to determine solely from the customer's account activity and KYC file?

The training department is conducting awareness training for unusual customer identification scenarios. Which two indicators should be included? (Select Two.)

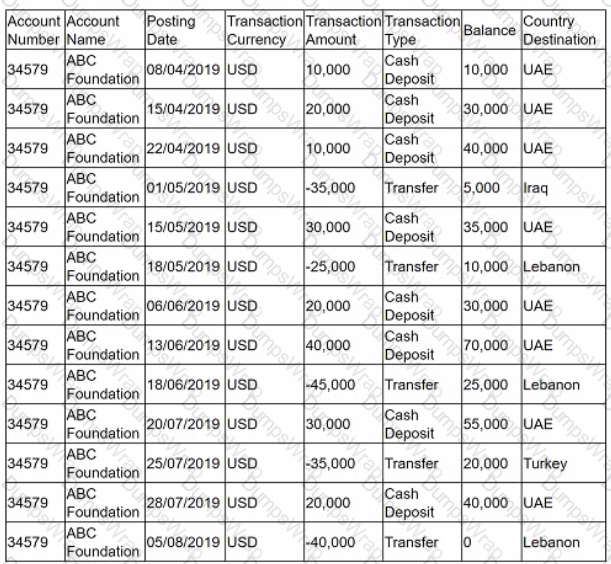

Each month the automated transaction monitoring system generates alerts based on predetermined scenarios. An alert was generated in relation to the account activity of ABC Foundation. Below is the transaction history for ABC Foundation (dates are in DD/MM/YYYY format).

The relationship manager for ABC Foundation contacts the client to request more information on the beneficiary of the transfer in Turkey. ABC Foundation advises that this is a not-for-profit charity group called 'Forever Free." Which is the best next step in the investigation?

During transaction monitoring. Bank A learns that one of their customers. Med Supplies 123. is attempting to make a payment via wire totaling 382,500 USD to PPE Business LLC located in Mexico to purchase a large order of personal protective equipment. specifically surgical masks and face shields. Upon further verification. Bank A decides to escalate and refers the case to investigators.

Bank A notes that, days prior to the above transaction, the same customer went to a Bank A location to wire 1,215,280 USD to Breath Well LTD located in Singapore. Breath Well was acting as an intermediary to purchase both 3-ply surgical masks and face shields from China. Bank A decided not to complete the transaction due to concerns with the involved supplier in China. Moreover, the customer is attempting to send a third wire in the amount of 350,000 USD for the purchase of these items, this time using a different vendor in China. The investigator must determine next steps in the investigation and what actions, if any. should be taken against relevant parties.

During the investigation, Bank A receives a USA PATRIOT Act Section 314(a) request related to Med Supplies 123. Which steps should the investigator take when fulfilling the request? (Select Three.)

The investigations team of a financial institution (Fl) wants to perform enhanced due diligence measures on operations done by a foreign bank related to transactions of companies that export scrap gold and silver. What would be the next best steps for the investigations team? (Select Two.)

Which might suggest misuse of crowdfunding resources by a terrorist?

Why is a more robust supervisory approach needed by regulators when overseeing small- and medium-sized money service businesses (MSBs) compared to larger MSBs for combatting terrorist financing (TF)?

A country that does not have strong predicate offenses and is lax in prosecuting AML cases could suffer which social/economic consequence?

During transaction monitoring. Bank A learns that one of their customers. Med Supplies 123, is attempting to make a payment via wire totaling 382,500 USD to PPE Business LLC located in Mexico to purchase a large order of personal protective equipment. specifically surgical masks and face shields. Upon further verification. Bank A decides to escalate and refers the case to investigators.

Bank A notes that, days prior to the above transaction, the same customer went to a Bank A location to wire 1,215,280 USD to Breath Well LTD located in Singapore. Breath Well was acting as an intermediary to purchase both 3-ply surgical masks and face shields from China. Bank A decided not to complete the transaction due to concerns with the involved supplier in China. Moreover, the customer is attempting to send a third wire in the amount of 350,000 USD for the purchase of these items, this time using a different vendor in China. The investigator must determine next steps in the investigation and what actions, if any. should be taken against relevant parties.

Upon further investigation. Bank As investigator learns that both the Mexico- and Singapore-based companies are linked to the alleged suppliers in China. Which additional indicators would the investigator need to identify to determine if this fits a fentanyl (drug) trafficking typology? (Select Two.)

Which are primary purposes of Financial Action Task Force {FATF)-Style Regional Bodies? (Select Two.)

The law enforcement agency (LEA) of a foreign jurisdiction contacts a financial institution (Fl) regarding one of the Fl's clients. The LEA advises that the client is currently wanted for prosecution as a result of a series of human trafficking charges. What should the Fl do? (Select Two.)

Which is a key characteristic of the Financial Action Task Force (FATF) Regional Style Bodies for combatting money laundering/terrorist financing?

What action does the USA PATRIOT Act allow the US government to take regarding financial institutions (FIs) that are based outside of the US?

An investigator at a corporate bank is conducting transaction monitoring alerts clearance.

KYC profile background: An entity customer, doing business offshore in Hong Kong, established a banking business relationship with the bank in 2017 for deposit and loan purposes. It acts as an offshore investment holding company. The customer declared that the ongoing source of funds to this account comes from group-related companies.

• X is the UBO. and owns 97% shares of this entity customer;

• Y is the authorized signatory of this entity customer. This entity customer was previously the subject of a SAR/STR.

KYC PROFILE

Customer Name: AAA International Company. Ltd

Customer ID: 123456

Account Opened: June 2017

Last KYC review date: 15 Nov 2020

Country and Year of Incorporation: The British Virgin Islands, May 2017

AML risk level: High

Account opening and purpose: Deposits, Loans and Trade Finance

Anticipated account activities: 1 to 5 transactions per year and around 1 million per

transaction amount

During the investigation, the investigator reviewed remittance transactions activities for the period from Jul 2019 to Sep 2021 and noted the following transactions pattern:

TRANSACTION JOURNAL

Review dates: from July 2019 to Sept 2021

For Hong Kong Dollars (HKD) currency:

Incoming transactions: 2 inward remittances of around 1.88 million HKD in total from

different third parties

Outgoing transactions: 24 outward remittances of around 9 4 million HKD in total to

different third parties

For United States Dollars (USD) currency:

Incoming transactions: 13 inward remittances of around 3.3 million USD in total from

different third parties

Outgoing transactions: 10 outward remittances of around 9.4 million USD in total to

different third parties.

RFI Information and Supporting documents:

According to the RFI reply received on 26 May 2021, the customer provided the bank

with the information below:

1) All incoming funds received in HKD & USD currencies were monies lent from non-customers of the bank. Copies of loan agreements had been provided as supporting documents. All of the loan agreements were in the same format and all the lenders are engaged in trading business.

2) Some loan agreements were signed among four parties, including among lenders. borrower (the bank's customer), guarantor, and guardian with supplemental agreements, which stated that the customer, as a borrower, who failed to repay the loan

Based on the KYC profile and the transaction journal, the pattern of activity shows a deviation in:

Sanctions screening requirements include that a financial institution should:

CLIENT INFORMATION FORM Client Name: ABC Tech Corp Client ID. Number: 08125 Name: ABC Tech Corp Registered Address: Mumbai, India Work Address: Mumbai, India Cell Phone: "*•"'" Alt Phone: "*""* Email: ........"

Client Profile Information:

Sector: Financial

Engaged in business from (date): 02 Jan 2020 Sub-sector: Software-Cryptocurrency Exchange Expected Annual Transaction Amount: 125,000 USD Payment Nature: Transfer received from clients’ fund

Received from: Clients

Received for: Sale of digital assets

The client identified itself as Xryptocurrency Exchange." The client has submitted the limited liability partnership deed. However, the bank's auditing team is unable to identify the client's exact business profile as the cryptocurrency exchange specified by the client as their major business awaits clearance from the country's regulator. The client has submitted documents/communications exchanged with the regulator and has cited the lack of governing laws in the country of their operation as the reason for the delay.

During the financial crime investigation, the investigator discovers that some of the customer due diligence (CDD) documents submitted by the client were fraudulent. The investigator also finds that some of the information in the financial institution's information depository is false. What should the financial crime investigator do next?

A client that runs a non-profit organization that aids refugees in leaving their home countries received a remittance from a money services business that was ten times the average. The client was recently detained for providing falsified passports to illegal immigrants. Which predicate offenses could be considered in the SAR/STR? (Select Two.)

A national financial intelligence unit (FIU) is undertaking the country risk assessment for the financing of the proliferation of weapons of mass destruction (WMD). The evaluation involves determining the exposure that financial institutions (FIs) have to operations that evade sanctions. Which should be performed by the FIU to assess proliferation financing risk? (Select Two.)

A financial institution

An investigator at a corporate bank is conducting transaction monitoring alerts clearance.

KYC profile background: An entity customer, doing business offshore in Hong Kong, established a banking business relationship with the bank since 2017 for deposit and loan purposes. It acts as an offshore investment holding company. The customer declared that the ongoing source of funds to this account comes from group-related companies.

• X is the UBO. and owns 97% shares of this entity customer;

• Y is is the authorized signatory of this entity customer. This entity customer was previously the subject of a SAR/STR.

KYC PROFILE

Customer Name: AAA International Company. Ltd

Customer ID: 123456

Account Opened: June 2017

Last KYC review date: 15 Nov 2020

Country and Year of Incorporation: The British Virgin Islands, May 2017

AML risk level: High

Account opening and purpose: Deposits, Loans, and Trade Finance

Anticipated account activities: 1 to 5 transactions per year and around 1 million per

transaction amount

During the investigation, the investigator reviewed remittance transactions activities for the period from Jul 2019 to Sep 2021 and noted the following transactions pattern:

TRANSACTION JOURNAL

Review dates: from July 2019 to Sept 2021

For Hong Kong Dollars (HKD) currency:

Incoming transactions: 2 inward remittances of around 1.88 million HKD in total from

different third parties

Outgoing transactions: 24 outward remittances of around 9 4 million HKD in total to

different third parties

For United States Dollars (USD) currency:

Incoming transactions: 13 inward remittances of around 3.3 million USD in total from

different third parties

Outgoing transactions: 10 outward remittances of around 9.4 million USD in total to

different third parties.

RFI Information and Supporting documents:

According to the RFI reply received on 26 May 2021, the customer provided the bank

with the information below:

1J All incoming funds received in HKD & USD currencies were monies lent from non-customers of the bank. Copies of loan agreements had been provided as supporting documents. All of the loan agreements were in the same format and all the lenders are engaged in trading business.

2) Some loan agreements were signed among four parties, including among lenders. borrower (the bank's customer), guarantor, and guardian with supplemental agreements, which stated that the customer, as a borrower, who failed to repay a loan

Which suspicious activity should the investigator identify during the review of the loan agreements?

Potentially suspicious activity following an increase in the volume of transactions by an import company included outgoing wires to Indonesia and Uganda referencing invoice numbers. Incoming funds included large cash deposits and checks/wires from pet stores, breeders, and private individuals. What financial crime might the bank reference in the SAR/STR?

An investigator is reviewing an alert for unusual activity. System scanning detected a text string within a company customer's account transactions that indicates the account may have been used for a drug or drug paraphernalia purchase Based on the KYC profile, the investigator determines the customer's company name and business type are marketed as a gardening supplies company. The investigator reviews the account activity and notes an online purchase transaction that leads the investigator to a website that sells various strains of marijuana. Additional account review detects cash deposits into the account at the branch teller lines, so the investigator reaches out to the teller staff regarding the transactions. The teller staff member reports that the business customers have frequently deposited cash in lower amounts. The teller, without prompting, adds that one of the transactors would occasionally smell of a distinct scent of marijuana smoke.

Which are the best next steps for the investigator to take? (Select Three.)

Which main vulnerability has led to an increase in the ransomware attacks perpetuated on small businesses?

A financial institution (Fl) has considered the available relevant factors in a transaction and has determined it will file a SAR^STR. Which is needed to support the contents of the report to the financial intelligence unit?

Which actions should financial institutions perform to ensure proper data governance? (Select Three.)