Certified Payroll Professional Questions and Answers

An employer that pays its state unemployment contributions after the due date of the Form 940 has its FUTA credit reduced by what percentage?

Nice Guys Inc. has a short-term disability plan, provided by a third-party insurance company, for its factory workers. Employees do not pay for this benefit. Roberta received $400 a month for four months during the six-month coverage period. How did the third-party payer tax Roberta's disability payments?

Which of the following groups BEST defines the term nonexempt under the FLSA?

Which of the following would NOT be an asset account?

Which of the following is most likely to be included in expenses on an organization’s financial statement?

When paying supplemental wages along with regular wages WITHOUT specifying the amount of each, how would a company determine the amount of income tax to withhold from the supplemental wages if the employee has been paid no supplemental wages so far during the year and the supplemental wage payment is no more than $1,000?

Employee's regular monthly salary is $950. Employee is scheduled to work 37 hours per week. Under the FLSA, how much would this employee be paid for each hour in excess of 37 but less than 40 in the workweek?

At the time that wages are paid, an advance payment of EIC would be recorded as:

The Fair Labor Standards Act specifically governs which of the following?

If an employee working abroad with a tax home in a foreign country passes the "physical presence test," to what may the employee be eligible?

Calculate the employee's gross pay under the FLSA based on the following data: Rate of pay per hour: $8.00 Production bonus: $25.00 Shift differential per hour: $$0.25 Total shift hours in workweek: 44

A report has been requested that is NOT a standard report from the system. This type of report is called a (n):

How should a manager provide negative feedback to an employee?

What is the payroll department manager responsible for in a company with strong internal controls?

Under the special accounting rule, employers may treat benefits earned near the end of the yare as having been earned in the subsequent year for tax and reporting purposes. Benefits for which month(s) may be treated as having been earned in the following tax year?

What is one of the major considerations when evaluating and selecting a software system for payroll?

Employees who are not eligible for direct deposit and receive paychecks sent through the mail are constructively paid:

Technology that allows multiple PC's in different geographical areas to access a single device, such as a check printer is:

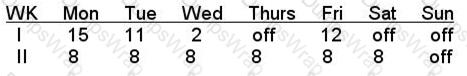

Under FLSA, how many hours must be paid at the overtime rate of pay for the following biweekly period assuming the employer is a hospital qualified under the special provisions of the FLSA?

Which of the following agencies would most likely enforce rules governing the number of days following the close of the payroll period that employees must be paid?

The FLSA term "exempt" generally means the employer need NOT:

Federal unemployment tax must be accrued for which of the following?

An integrated HRIS offers the advantage of:

Which of the following would not be included in the planning stage of a system implementation?

A pre notification may be used when an employee:

An HRIS that has one database with functionality pertaining to multiple applications is often called a (n)

Under the claim-of-right rule, a salary overpayment that is discovered by the employer in the tax year following the year of overpayment:

The primary responsibility of Professional Employer Organizations is:

Which of the following describes a plan involving the entire organization for carrying on a company's business in the event of a major disaster?

Which of the following would not be included in the Needs Analysis stage of a system evaluation?

The entry to record a salary advance to an employee is:

Under the Immigration Reform and Control Act, employers and employees are required to complete which of the following forms:

Which of the following represents the best way of addressing an issue of an employee's poor task performance?

Which of the following is an example of a system edit?

If a company is examining the feasibility of purchasing an integrated human resource information system (HRIS), what approach is best?

All of the following steps are required when initiating direct deposit for an employee EXCEPT:

As part of the implementation of a new payroll system, all transactions from the most recent actual payroll are processed in the new system prior to using the system to run payrolls. This is an example of what type of testing?