CMA Part 2: Strategic Financial Management Exam Questions and Answers

Which one of the following situations describes a secondary offering of stock by a company?

Company Y records a receivable from a foreign customer in Company Y's functional currency. The receivable is due in 90 days and is to be paid in the customer s currency. This is an example of which type of risk exposure?

The best discount rate to the use for evaluate of investment opportunities is the

A company is considering investing £1 million for a new machine. The new machine is expected to generate £450,000 incremental before-tax operating cash inflows and £100.000 in additional depreciation expense for each of the next ten years. The company uses the same depreciation assumptions tor book and tax purposes. If the company's income tax rate is 30%, what is the change in the yearly after-tax cash flow from operations if the company invests in the new machine?

A group of nations is considering me formation of a cartel associated with the manufacture and distribution of a product that they each export. Which one of the following outcomes would not be consistent with me formation of a carter?

Clark inc, expects to incur the following selected costs an a new product being planned for introduction early next.

- Design an development costs of $100,000 that will be incurred this year.

- Marketing costs of $50,000 to be incurred %50 this year %50 year

- Manufacturing costs of $500,000 to be incurred next year.

- In addition to external market factors, the pricing decision should be based on cost. The product cost that should be used is

A co league claims that morality is usually perceived and interpreted differently by different people so there is no method to judge whether one decision is better than another. This is commonly referred to as

Accounts receivable turnover increases from 4.0 times to 6.0 times. It all sales are on account when one of the following must decrease?

if a company increases the price of its product from $3010 $35, demand would decrease from 30, 000 units to 20.000 units. What is the price elasticity of demand for the company using the midpoint formula?

Identify and explain two risks that Guda may face after it acquires Blue Moon.

Essay

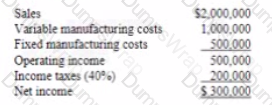

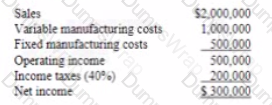

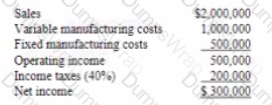

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

Explain the impact of a sales price adjustment on AMI’s operating income if AMI’ s operating leverage is higher than that of other companies in its market.

Essay

Food Depot Ltd, (FDL) is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants, FDL has been profitable in recent years and has a very strong cash position. FDL's newest division. Food_TO-Go is an online meal ordering and delivery platform acquired by FDL two year ago.

In 20X7, sales for the entire company were $1 billion, with 50% of the business coming from the Airline Catering division. FDL is the country ‘s leading airline catering services provider and control 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-division only contribution 5% of FDL’s total sales in 20X7 and is far behind in competing for marketing for market share of the online meal ordering and delivery industry, it is estimated that Food-To-Go’s sales were only 20% of the industry leader’s sales. However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

Susan Willey, the head of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company. Wiley argues that ber division bad the highest ROI in 20X7, and it deserves more capital finding. FDL’s requested rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follow (in $ millions)

Calculate QDDs financial leverage ratio show your calculations

Essay

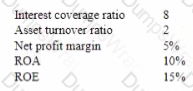

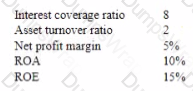

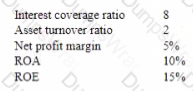

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

Identify and describe two defenses Blue Moon could use if it does not wish to be acquired by Guda.

Essay

Food Depot Ltd, (FDL) is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants, FDL has been profitable in recent years and has a very strong cash position. FDL's newest division. Food_TO-Go is an online meal ordering and delivery platform acquired by FDL two year ago.

In 20X7, sales for the entire company were $1 billion, with 50% of the business coming from the Airline Catering division. FDL is the country ‘s leading airline catering services provider and control 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-division only contribution 5% of FDL’s total sales in 20X7 and is far behind in competing for marketing for market share of the online meal ordering and delivery industry, it is estimated that Food-To-Go’s sales were only 20% of the industry leader’s sales. However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

Susan Willey, the head of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company. Wiley argues that ber division bad the highest ROI in 20X7, and it deserves more capital finding. FDL’s requested rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follow (in $ millions)

Explain now QDD's share repurchase plan would affect each of the following measures EPS, the degree of operating leverage, and the interest coverage ratio No calculations required

Essay

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

Assuming mere are no other imitations, should AMI accept the one-time order from a financial perspective? Explain your answer

Essay

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

Identify and explain two ways for AMI to hedge its exchange rate risk.

Essay

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

Discuss whether AMI should use a cost-based or a market-based pricing approach. Explain your answer.

Essay

Food Depot Ltd, (FDL) is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants, FDL has been profitable in recent years and has a very strong cash position. FDL's newest division. Food_TO-Go is an online meal ordering and delivery platform acquired by FDL two year ago.

In 20X7, sales for the entire company were $1 billion, with 50% of the business coming from the Airline Catering division. FDL is the country ‘s leading airline catering services provider and control 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-division only contribution 5% of FDL’s total sales in 20X7 and is far behind in competing for marketing for market share of the online meal ordering and delivery industry, it is estimated that Food-To-Go’s sales were only 20% of the industry leader’s sales. However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

Susan Willey, the head of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company. Wiley argues that ber division bad the highest ROI in 20X7, and it deserves more capital finding. FDL’s requested rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follow (in $ millions)

Explain one reason each Tot and against issuing bonds with a call feature

Essay

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments