Microsoft Dynamics 365 Finance Questions and Answers

You need to correct the sales tax setup to resolve User5's issue.

Which three actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You need to determine why CustomerX is unable to confirm another sales order.

What are two possible reasons? Each answer is a complete solution.

NOTE: Each correct selection is worth one point.

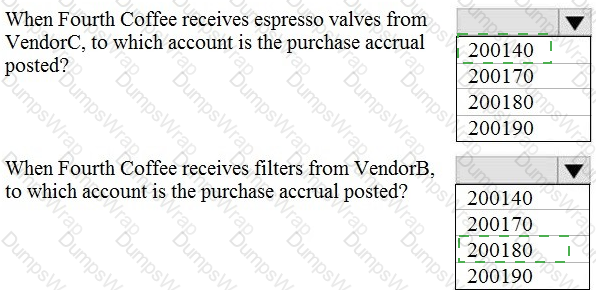

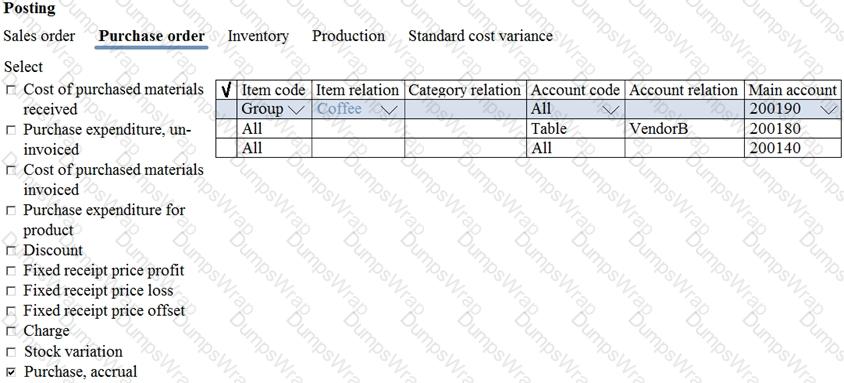

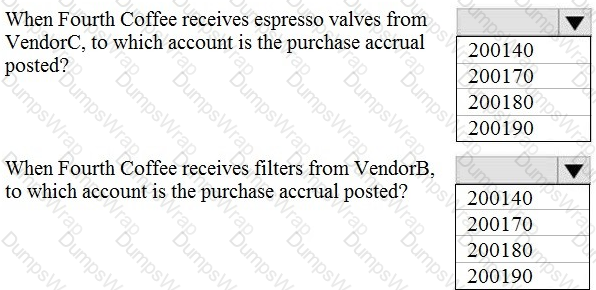

The posting configuration for a purchase order is shown as follows:

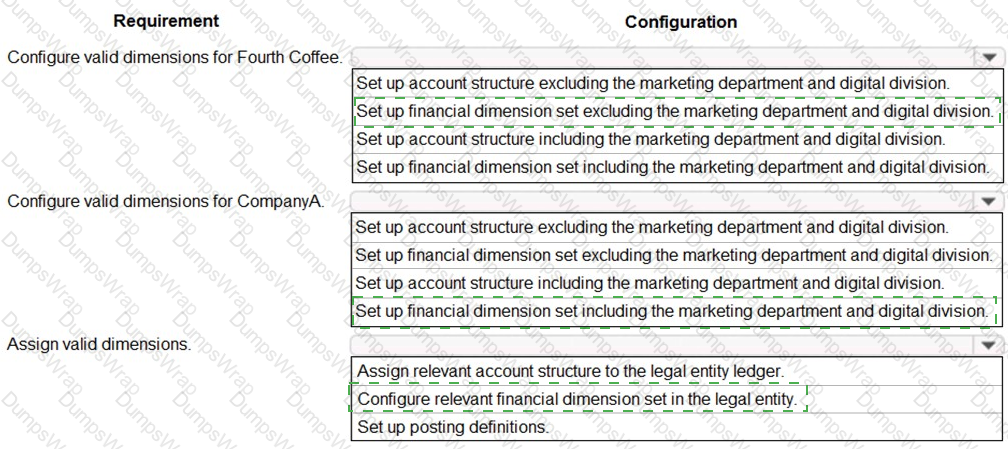

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

You need to configure the system to resolve User8's issue.

What should you select?

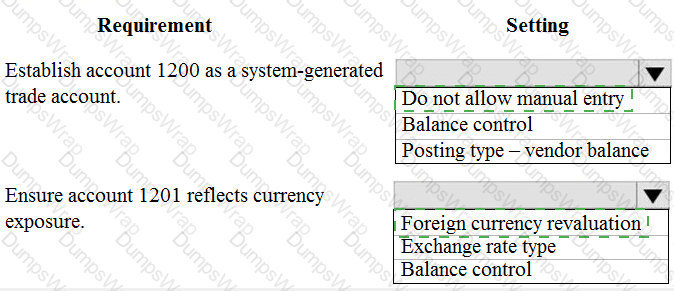

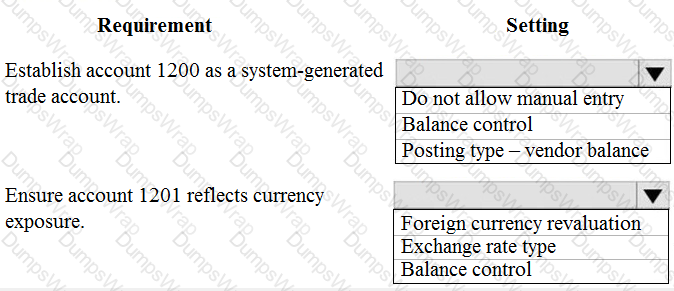

You need to configure settings to resolve User1’s issue.

Which settings should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to ensure that User9's purchase is appropriately recorded.

Which three steps should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You need to view the results of Fourth Coffee Holding Company's consolidation.

D18912E1457D5D1DDCBD40AB3BF70D5D

Which three places show the results of financial consolidation? Each correct answer presents a complete

solution.

NOTE: Each correct selection is worth one point.

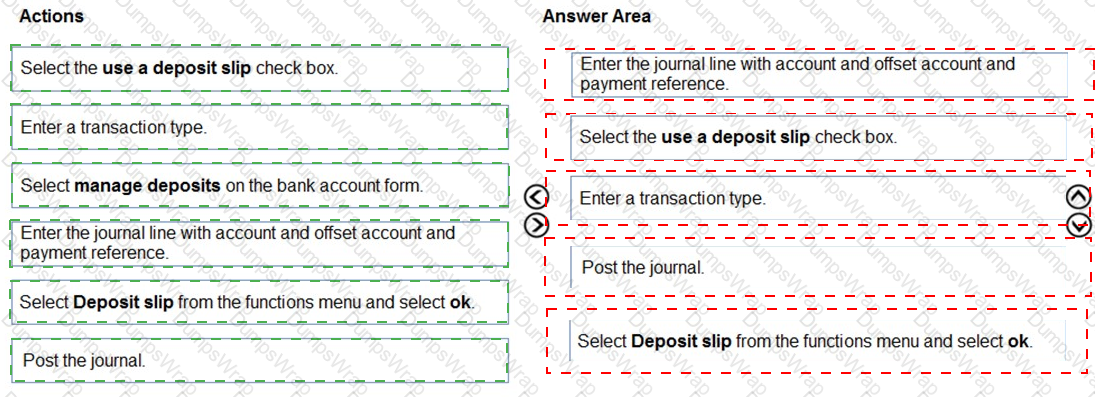

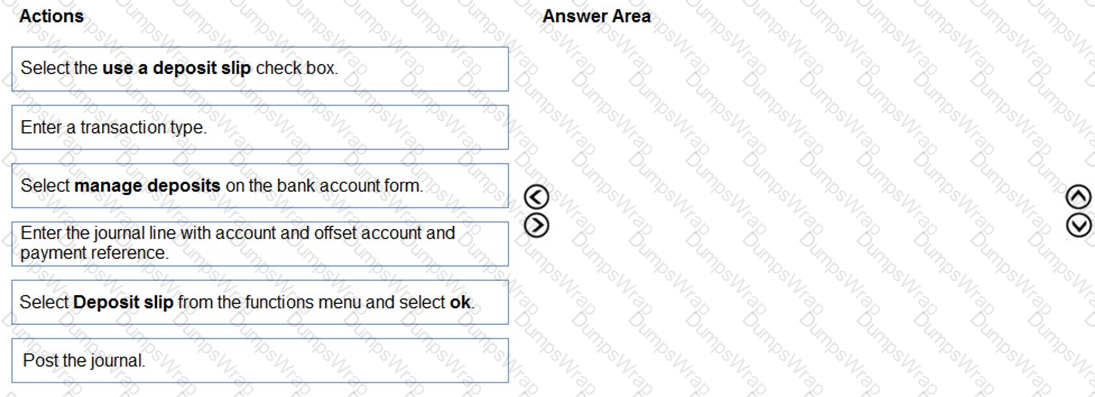

You need to assist User3 with generating a deposit slip to meet Fourth Coffee's requirement.

Which five actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

You need to configure settings to resolve User8’s issue.

What should you select?

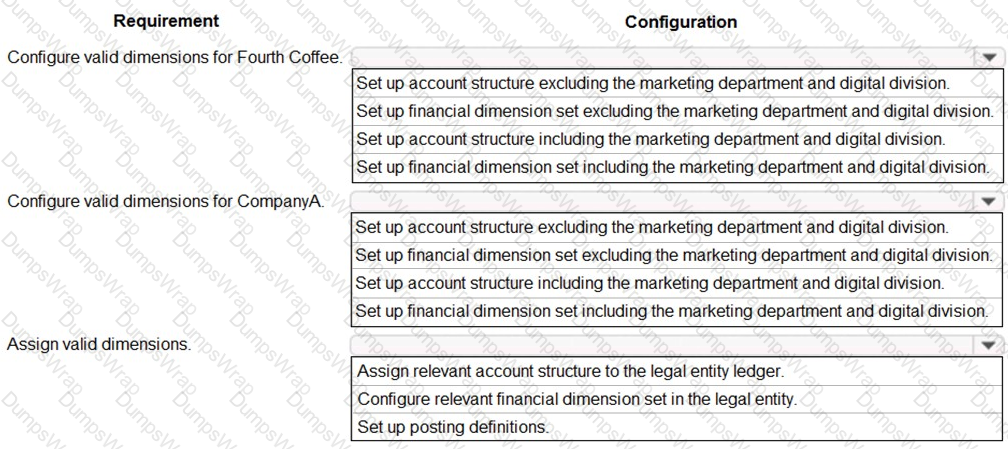

You need to prevent a reoccurrence of User2’s issue.

How should you configure the system? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to troubleshoot the reporting issue for User7.

Why are some transactions being excluded?

You need to recommend a solution to prevent User3's issue from recurring.

What should you recommend?

You need to identify the root cause for the error that User5 is experiencing.

What should you check?

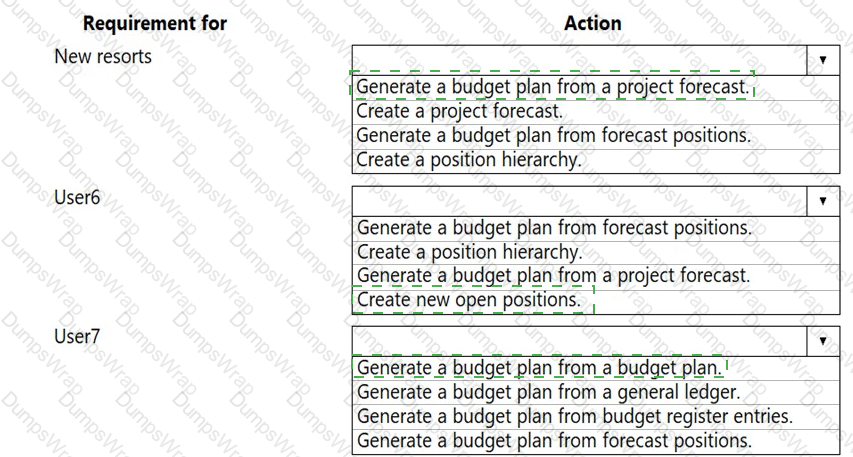

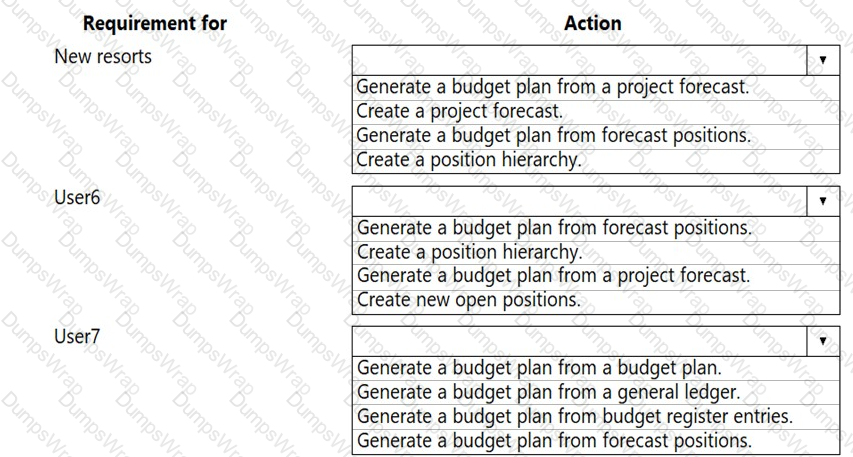

You need to configure the system to meet the budget preparation requirements.

What should you do? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to acquire the fixed assets that are associated with the purchase orders.

What should you do?

You need to configure budget planning for Alpine Ski House Corporate.

Which two components should you configure? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You need to adjust the sales tax configuration to resolve the issue for User3.

What should you do?

You need to resolve the issue that User4 reports.

What should you do?

You need to determine the cause of the issue that User1 reports.

What are two possible causes for the issue? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

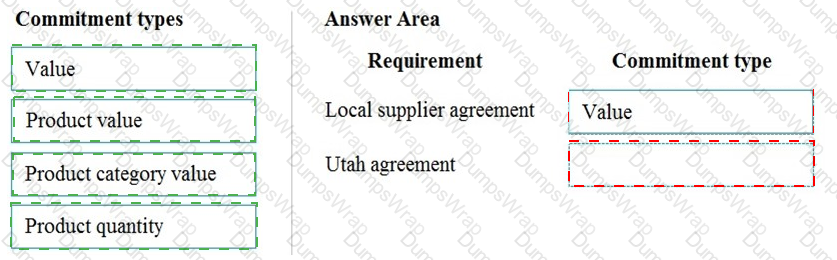

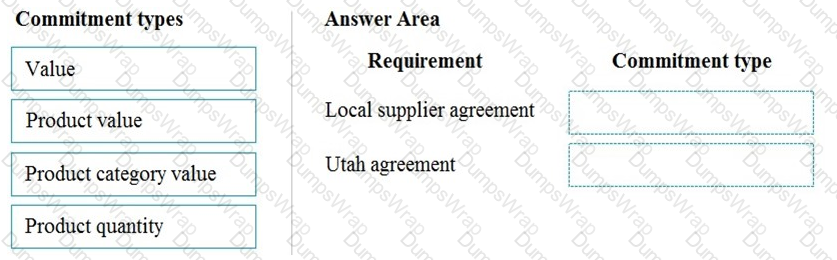

You need to configure the system to for existing purchasing contracts.

Which commitment types should you use? To answer, drag the appropriate commitment types to the correct requirements. Each commitment type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to prevent the issue from reoccurring for User5.

What should you do?

The Canadian franchise purchases excess ski equipment from the US franchise. Two sets of skis are

purchased totaling USD1,000.

When the purchase invoice is prepared, USD10,000 is keyed in by mistake.

Which configuration determines the result for this intercompany trade scenario?

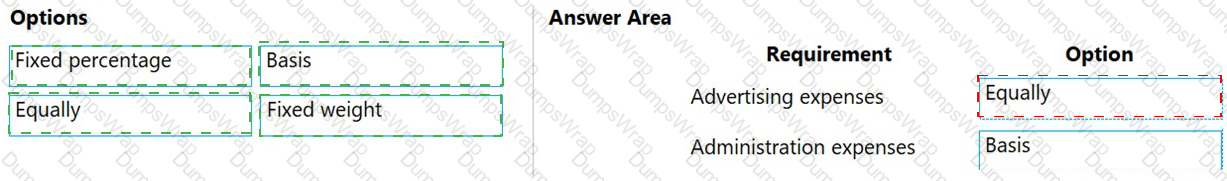

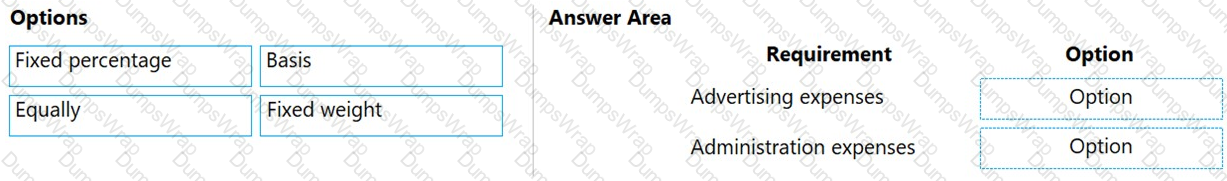

You need to configure ledger allocations to meet the requirements.

What should you configure? To answer, drag the appropriate setups to the correct requirements. Each setup may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You are configuring automatic bank reconciliation functionality for a company that has multiple bank accounts, The company wants to import their bank statements.

You need to import electronic bank statements to reconcile the bank accounts.

Which three actions can you perform? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

A company uses the credit and collections features of Dynamics 365 Finance to track invoices and incoming payments from customers.

You need to configure the automatic collection task.

Which two options should you configure? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You are setting up the yearly budget for an organization for the year 2019.

You need to set up the budget register entries.

Which two fields must be set up when creating register entries? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

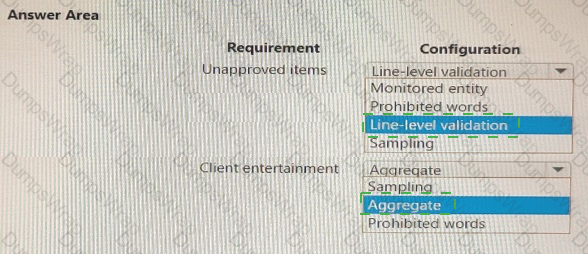

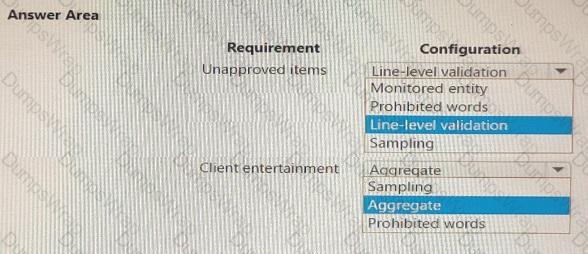

You need to prevent prohibited expenses from posting.

Which configurations should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to identify the posting issue with sales order 1234.

What should you do?

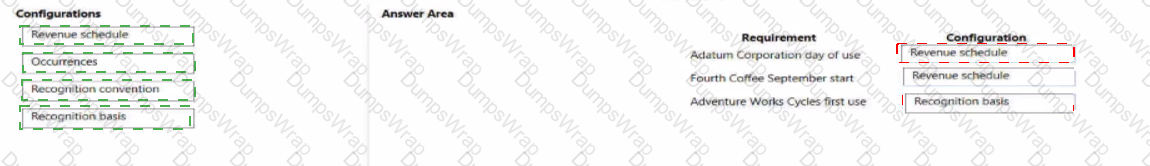

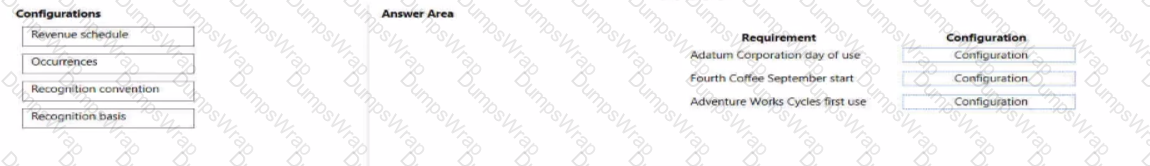

You need to configure revenue recognition to meet the requirements.

Which configuration should you use? To answer, drag the appropriate configurations to the correct requirements. Each configuration may be used once, more than not at all. You may need to drag the split bar between panes or scroll to view content

NOTE: Each correct selection is worth one point

You need to configure the system to meet the fiscal year requirements. What should you do?

You need to address the employees issue regarding expense report policy violations.

Which parameter should you use?

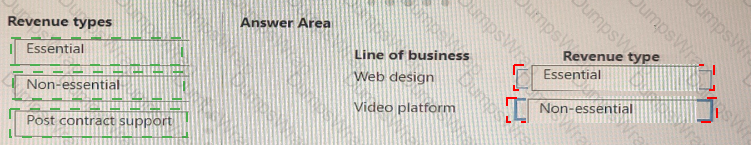

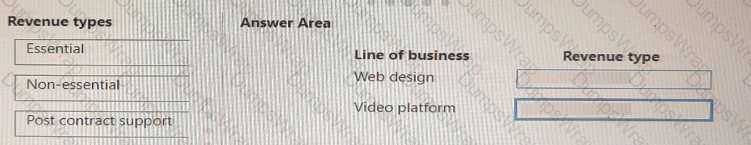

You need to configure recognition.

Which revenue type is associated with the line of business? To answer, drag the appropriate revenue types to the correct lines of business. Each revenue type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

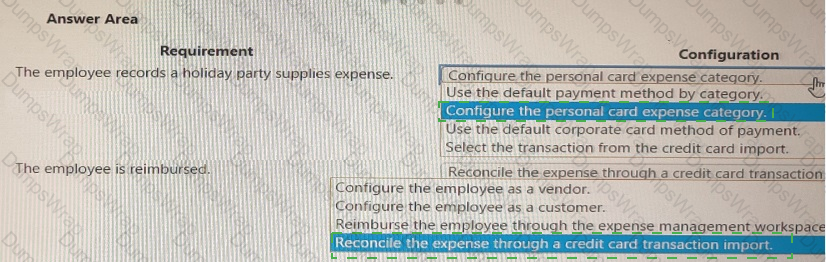

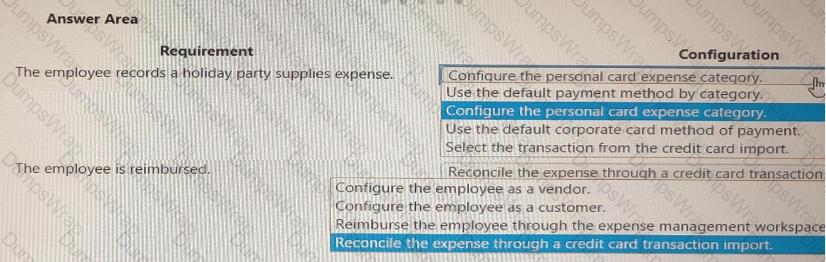

You need to configure the expense module for reimbursement.

How should you configure the expense module? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need in BUI that captured employee mobile receipts automatic ally match the transactions to resolve the User1 issue.

Which feature should you enable?

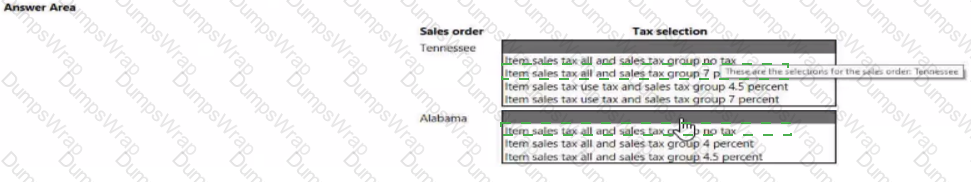

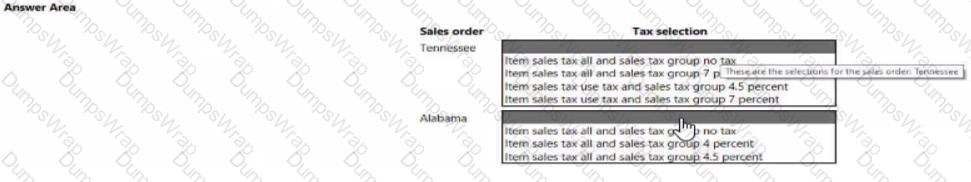

You need to validate the sales tax postings for Tennessee and Alabama.

Which tax selections meet the requirement? To answer. select the appropriate options in the answer area

NOTE: Each correct selection is worth one point.

You need to address the posting of sales orders to a closed period.

What should you do?

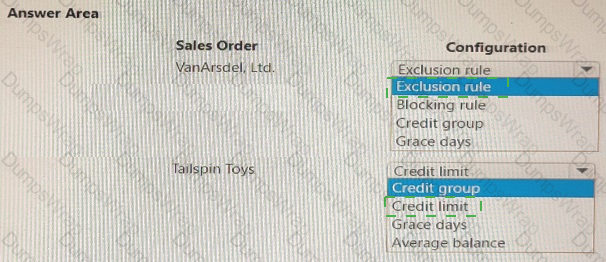

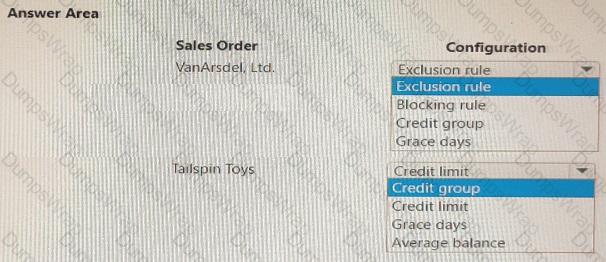

You need to identify why the sales orders where sent to customers.

Which configuration allowed the sales orders to be sent? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct select is worth one point.

You need to ensure Trey Research meets the compliance requirement.

Which budget technology should you implement? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point

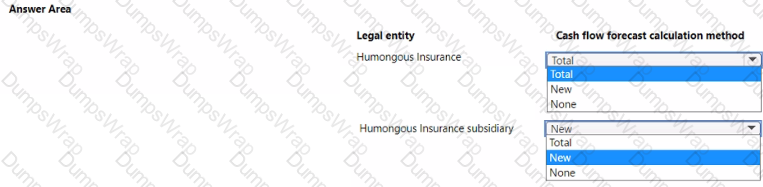

You need to configure the cash flow management reports.

How should you configure cash flow management? To answer, select the appropriate options m the answer area.

NOTE: Each correct selection is worth one point.

You need to set up financial reports to meet management requirements. What should you do? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

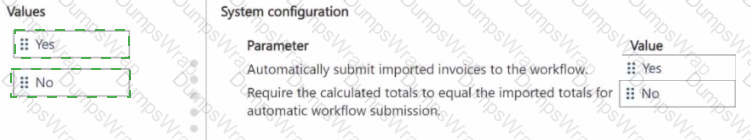

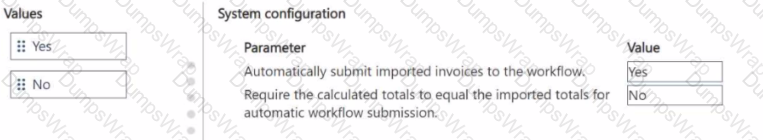

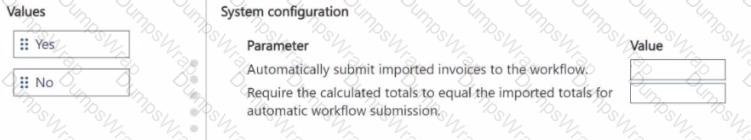

You need to resolve the accounts payable manager issue and resolve the user acceptance testing bug reported by the accounts payable clerk.

How should you configure the system? To answer, move the appropriate Value to the correct Parameter. You may use each Value once, more than once, or not at all. You may need to move the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to enforce financial budgets for management and resolve User As issue. What should you do?

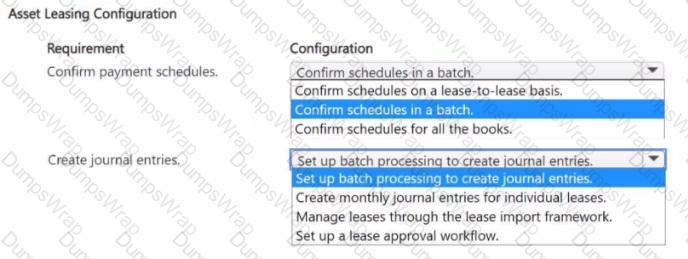

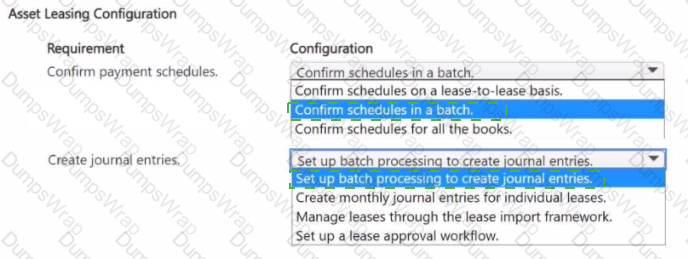

You need to resolve the issue related to monthly lease expenses.

How should you configure asset leasing? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.