SAP Certified Associate - Implementation Consultant - SAP SuccessFactors Variable Pay Questions and Answers

Company ABC rewards its employees using an additive plan based on company (50% weight) and individual (50% weight) performance. An employee’s target bonus is 4,000 (100% payout). The company performance is based on two objectives, each weighted at 50% — revenue and operating Income. The revenue objective achievement is 80% and the operating income objective achievement is 90%. If the Individual achievement is 150%, which expression best represents how the bonus is calculated?

You have an Employee Central client who wants to calculate the basis, based on employee-specific data. From which of the following areas can you get this data? Note: There are 2 correct answers to this question.

Which bonus plan configuration is available only when using an import file?

The employee history data file import process was completed but returned with errors. Given the information in the screenshot, which column is causing the error message?

Which of the following scenarios are good uses of a global eligibility rule in an Employee Central integrated template? Note: There are 2 correct answers to this question.

Which steps should you take to activate the Variable Pay Individual View? Note: There are 3 correct answers to this question.

Which of the following can be achieved using variable pay gates? Notes: There are 2 correct answers to this question.

A performance management (PM) form will be considered a match to an assignment when its period overlaps with the period of the assignment. Which combination of conditions qualifies as "overlap"?

In which ways can the basis be configured in a non-EC integrated plan? Note: There are 2 correct answers to this question.

Which of the following tools can you use to reorder the fields in the Assignment Details section (as shown in the screenshot)?

Where do you define the payout function type?

Your client wants to award quarterly bonuses, where the quarters are aligned as follows: Q1: November 1–January 31. Q2: February 1–April 30. Q3: May 1–July 31. Q4: August 1–October 31. Bonuses are paid at the end of each quarter. Which of the following combinations of configuration options would work for this scenario?

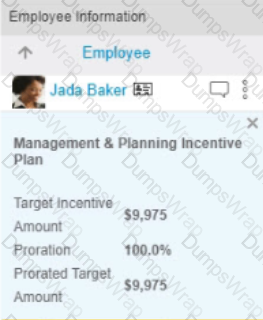

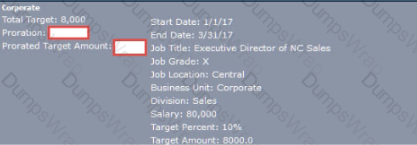

A customer's variable pay program dates are January 1 to December 31, 2017. Given the screenshot below, what are the approximate Proration and Prorated Target Amount for this assignment?

Which field types can be added to the variable pay background section? Note: There are 3 correct answers to this question.

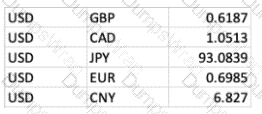

The screenshot below is the entire currency conversion table. The functional currency of this customer is USD. Which currency view modes can be used with this table?

What task can you complete in Configure Label Names and Visibility?

Which of the following system-standard equations are considered to be multiplicative formulas? Note: There are 3 correct answers to this question.

Assume a starting point of “All employees are eligible” and all employees will appear on the worksheet regardless of employee history. Why would you use Manager Form Eligibility Rules?

In which file do you specify the relationship between bonus plan and business goals?

In which customer scenarios are multiple bonus plans required in a single program? Note: There are 2 correct answers to this question.

Manager form eligibility rules are written to exclude employees in specific business units. Based on this information, which setting must be enabled for the plan to include the correct employees?

Which tools can employees use to see the final payout amount awarded to them? Note: There are 3 correct answers to this question.

Your customer, who has offices in the US and Germany, has the following two bonus schemes: Revenue Enabling Bonus. Revenue Generating Bonus. US employees in the Revenue Enabling Bonus scheme are weighted 40% Business Achievement and 60% Personal Achievement, while inGermany, it is 50% for each. They all have the same business goal: "Corporate Results". US employees in the Revenue Generating Bonus scheme are weighted 35% Business Achievement and 65% Personal Achievement. The only business goal is "Country Results", where the goal achievement differs between the US and Germany. What is the minimum number of bonus plans required to meet this requirement?

What report requires that worksheets have been launched before it will show results?